The FCA 2020/21 Business Plan – a focus on Coronavirus challenges, some familiar themes but also a new approach?

Insight

Introduction

On 7 April the FCA published its 2020/21 Business Plan which sets out its main areas of focus for 2020/21 and priority areas over the next one to three years. It should be read in conjunction with the FCA sector views published on 18 February 2020 and which we comment on here.

Unsurprisingly, the FCA’s immediate focus is to deal with the challenges resulting from the Coronavirus emergency.

“The global economy faces massive challenges from Coronavirus. The effects will be profound, and will be felt by millions of consumers and businesses.”

FCA Business Plan

The Business Plan also sets out key priority areas for the medium term which reflect the FCA’s statutory objectives in particular that the markets function well and protecting consumers.

“We will not compromise our expectations of firms, particularly that they make consumers’ interests the foundation of their business models and behave accordingly.”

FCA Business Plan

The FCA has included its own transformation as an additional priority with the stated aim of becoming a more integrated regulator with a greater focus on outcomes.

In relation to supervision the FCA confirms its continuing focus on firms’ culture, which will include assessment of the drivers of culture, including looking at firms’ leadership, purpose, governance and approach to managing and rewarding their people. In a change of direction, the FCA has indicated smaller firms are likely to experience greater engagement and scrutiny from the FCA than they have in the past.

“We will be shifting our focus towards smaller firms.”

FCA Business Plan

Given the uncertainties created by Coronavirus, the FCA makes clear that the Business Plan is likely to be reviewed and may be updated as the situation becomes clearer.

This briefing outlines the key points from the 2020/21 Business Plan as originally published.

Immediate plans – Coronavirus response

The Business Plan confirms that in the face of an unprecedented challenge caused by the Coronavirus, the FCA is currently focusing its efforts on ensuring that markets continue to function, whilst ensuring the most vulnerable people are protected and consumers and small firms are treated fairly. Where firm failures do occur, the FCA will be working with firms to ensure that the impact of this is minimised. The FCA confirms that it will remain vigilant to potential misconduct with a warning to those who think that the current situation provides an opportunity for poor behaviour.

The Business Plan highlights the series of rapid interventions already made by the FCA, alongside HM Treasury and the Bank of England, to protect consumers, firms and the markets, noting that it is a fast moving situation and further action is likely.

The Business Plan notes the open and constructive engagement between the FCA and stakeholders including firms and industry associations since the start of the Coronavirus emergency. This is a welcome recognition from the FCA of how the industry and the regulator can work well together. The next phase of the emergency, as the interventions made are eased or come to an end, is likely to prove even more challenging and we would hope that this collaborative approach will continue.

Medium-term plans – 5 Key priorities

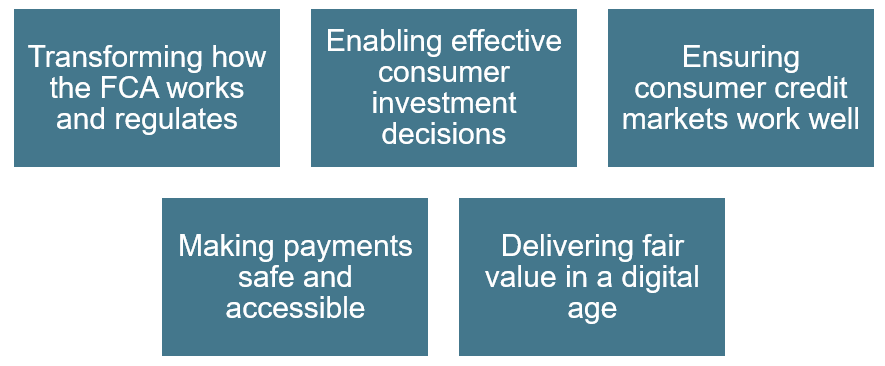

The Business Plan outlines the FCA’s 5 key priorities for the medium term. These are:

Transforming how the FCA works and regulates

The FCA has set out ambitious plans to change fundamentally the way it works with the aim of becoming a more efficient and effective regulator. The FCA highlights its key aims, as follows:

- Make faster and better decisions – The FCA notes that as the regulatory context becomes more complex and the number of firms it regulates increases it will need to invest in and develop its capabilities, enabling the FCA to make well informed decisions more quickly. The FCA wants to become a more integrated regulator – a so called “One FCA”.

- Prioritise end outcomes for consumers, markets and firms – The FCA intends to focus on end outcomes and wants firms to take end outcomes for consumers and markets into greater account when they design and deliver services. To help firms the FCA will be clearer about the outcomes it expects.

- Intelligence and information – The FCA will be making changes to the way it identifies, prioritises and acts on the intelligence it receives with the aim of a more focused and co-ordinated approach. This should also allow the FCA to identify harm more quickly. In a welcome move the FCA also confirms that it will be seeking better coordination with other regulators and is looking at giving the industry a two year forward look of major regulatory initiatives.

- Influence internationally – In a post EU withdrawal, tech enabled world the FCA wants to build stronger links with partners globally and to continue to shape the future of financial regulation internationally.

Enabling effective consumer investment decisions

The risk of harm to customers resulting from unsuitable investment decisions was highlighted in the FCA’s sector views as a significant area of concern, and this has carried through to the Business Plan which proposes a consumer harm campaign to help customers make better investment decisions.

The Business Plan notes the importance of ensuring that firms in the pensions and retail investment sector, including those in the distribution chain, operate to high regulatory standards and act in accordance with consumers’ interests. Firms should expect increasing scrutiny from the FCA in this area.

Ensuring consumer credit markets work well

Recognising that the demand for credit is strongly linked to economic factors, the FCA expects the Coronavirus to have a major impact on this market and in particular the vulnerable. In response the FCA is proposing measures that will allow firms to exercise greater flexibility where it is in the best interests of consumers.

The FCA’s approach will be shaped and influenced by the economic impact of the response to the Coronavirus, and it will be looking to achieve the following outcomes:

- Consumers can find the products that meet their needs – clear and simple information should be made available.

- Consumers do not become over-indebted by credit they cannot afford – firms should not benefit from exploitative fees and charges.

- Affordable credit is available to smooth consumption – the FCA will work with government to increase access to fair and affordable credit.

- Consumers can take control of their debt at an early stage – firms should identify consumers at risk at an early stage and give them suitable forbearance.

Making payments safe and accessible

The FCA acknowledges the rapid expansion and development of the payments services sector and wants to ensure that consumers and SMEs can safely access the variety of payment services available. The FCA is concerned that the Coronavirus emergency will impact payment services firms’ financial strength and the ability of consumers to access services.

In response, and together with other regulators, the FCA’s work will be focused on ensuring that:

- Consumers can transact safely with payment firms – data must be handled and stored correctly, and firms must minimise the potential for fraud, operational outages and financial crime.

- Payment firms meet their regulatory responsibilities while competing on quality and value – firms must comply with their safeguarding and other regulatory requirements and the FCA will act quickly if they do not.

- Consumers and SMEs have access to a variety of payments services – particular groups should not be excluded and access to cash must be maintained.

Delivering fair value in a digital age

The FCA has seen greater use of digitisation in the firms it regulates and expects the social changes driven by Coronavirus to accelerate this trend.

The FCA recognises that it will need to ensure that it has the necessary skills and focus to supervise effectively in a digital age. The FCA highlights the potential disproportionate impact on vulnerable customers, who may be “digitally disenfranchised”. The Business Plan also mentions the importance of consumers benefitting from digital innovation and competition, but they need to be confident that they are getting fair access, price and quality.

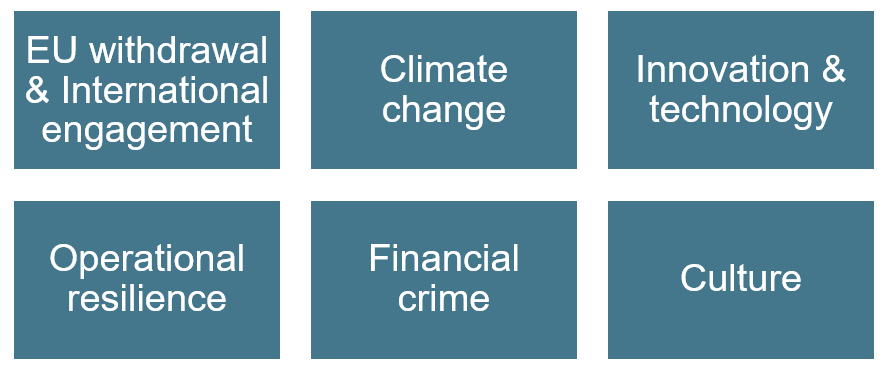

Cross-cutting work

Alongside the 5 key priorities, the FCA will be working across sectors in areas that have a broad market impact. These areas are:

If you require further information about anything covered in this briefing, please contact Grania Baird or Kay Lubwika Bartlett or your usual contact at the firm on +44 (0)20 3375 7000.

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, May 2020