Structuring for success: investing tax-efficiently in UK businesses

Insight

1. Background

1.1 Notwithstanding various recent legislative changes, the UK remains a ‘business-friendly’ jurisdiction in which to invest from a tax perspective. Most notably, non-UK residents will still not normally be liable for any UK tax on income and capital gains they receive from UK businesses (subject to some new exceptions for certain sectors, such as property).

1.2 For UK residents however, the situation is more complex, since individuals selling a business will be potentially liable to UK capital gains tax at up to 20% on their sale profits, in addition to income tax at up to 38.1% on any dividends.

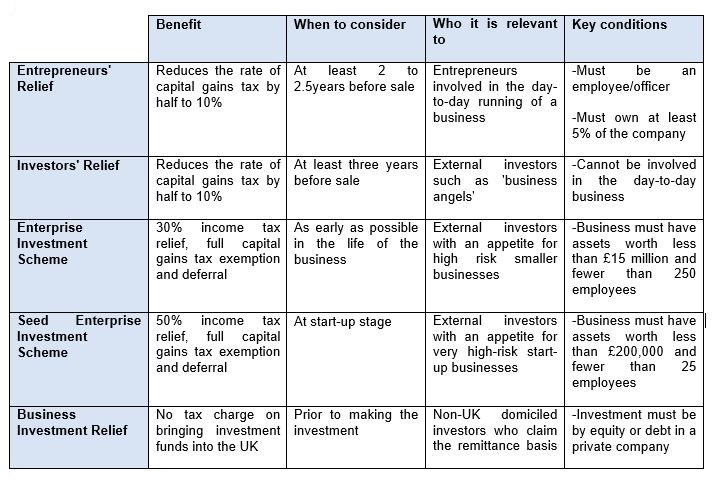

1.3 Fortunately, there are numerous tax incentives and reliefs which can mitigate the tax burden for UK investors. This note provides simple case studies and outlines the main tax incentives and reliefs which will be relevant for UK entrepreneurs and investors who are looking to reduce their tax exposure. An outline of the main reliefs covered in this note is below:

1.4 The information below is intended to help investors and entrepreneurs identify which relief or incentive is likely to be most appropriate for their circumstances. However, the tax rules here can be extremely complex to apply and so bespoke legal and tax advice should always be sought as early as possible.

2. Entrepreneurs' Relief (ER)

Case Study

2.1 Mr Smith started a successful software company several years ago and he has been approached by a potential private equity buyer looking to purchase the business. He is a director of the company and has been actively involved in it since it started. The business is owned by Mr Smith and his three business partners in equal shares, with some family members also having minority shares.

2.2 Because Mr Smith has a significant (more than 5%) shareholding in a privately-owned business, he should consider whether he can claim ER before selling. If he can structure the sale properly, this relief could reduce his tax bill on the sale by half.

The Relief

2.3 ER is a long-established relief from capital gains tax targeted at UK resident entrepreneurs who are involved in the day-to-day running of their business. It reduces the rate of tax charged on a sale/IPO of a business from 20% to 10% and it is available for each individual's first £10 million of qualifying capital gains.

Planning ideas

2.4 ER is available on an exit from either an incorporated or unincorporated business.

2.5 If the business is incorporated, the exit must take the form of the sale/IPO of shares (or sometimes loan notes) in a trading company or in a holding company of a trading group. Throughout the period of two years before the sale, the person claiming the relief must have been a full or part-time employee or officer (e.g. a director) of the company or group and must have held at least 5% of the ordinary shares and voting rights as well as 5% of the company's distributable profits and assets on a winding up.

2.6 If the business is unincorporated then there is no 5% minimum ownership requirement, but the business must still have been owned by the individual throughout the period of two years before sale. Any assets held by the business for investment purposes will not qualify for ER.

2.7 For individuals who are nearing, or who may exceed, their £10 million lifetime ER limit, it may be possible to transfer sufficient shares to family members for them to use their own allowances instead. In order for the family members to benefit from ER, they would need to be appointed as an employee or officer (often as company secretary) and they must hold the shares for at least one year before sale (unless they have already held a sufficient 5% interest). It is important to also be mindful of other tax issues which may arise with this sort of planning, such as inheritance tax and stamp duty.

2.8 To accommodate the conditions for ER, changes may need to be made to the business structure and ownership. The company's Articles of Association and any Shareholders' Agreement may need to be updated accordingly. These documents should therefore be reviewed in advance to facilitate the ER planning and ready the business for sale.

Timing

2.9 Individuals who are considering claiming ER must ensure an appropriate structure is in place at least 2 years before an exit.

2.10 However, re-structuring during the lifespan of a business can be complex and may trigger other adverse tax charges and professional fees, which could mitigate the effectiveness of ER. Ideally, entrepreneurs should therefore plan and structure for ER earlier in the life of the business, ideally at the outset.

3. Investors' Relief (IR)

Case Study

3.1 Ms Brown is an established entrepreneur and now acts as a 'business angel' to offer financial support and advice to new businesses. Whilst she is happy to act as an unpaid non-executive director to offer advice, she does not want to play a 'hands on' role in the business. She is mindful of investing as tax efficiently as possible, but she does not want to force the business to restructure to accommodate her wishes.

3.2 As an external business investor, Ms Brown should consider whether IR is available for her prospective investment. IR is not subject to the same minimum shareholding requirements as ER, so she is free to invest as much or as little as she wishes without the need to restructure the business. By securing IR, Ms Brown could reduce her tax bill by half when she sells her investment.

The Relief

3.3 IR is a new form of capital gains tax relief modelled loosely on ER. However, whereas ER is targeted at those in a 'hands on' position running the business, IR is instead aimed at external investors.

3.4 As with ER, IR reduces the rate of tax applicable to the gain on a sale/IPO from 20% to 10%. The relief applies to each investor's first £10 million of qualifying capital gains where they (or a trustee in certain circumstances) make a claim in their annual self-assessment tax return. The £10 million IR limit is entirely separate to the £10 million ER limit, so it can be used even after an entrepreneur has exhausted their ER allowance.

Planning ideas

3.5 Unlike ER, which is available for either unincorporated and incorporated businesses, IR is only available on the sale/IPO of shares in an incorporated business. The investor must hold shares in a trading company (or holding company of a trading group) which meet certain conditions to qualify for the relief:

3.5.1 the shares must be fully paid ordinary shares that were issued to the investor in return for cash on or after 17 March 2016;

3.5.2 at the time the shares were issued, none of the company's shares can be listed on a stock exchange;

3.5.3 the investor must have continuously held the shares and for at least three years since 6 April 2016; and

3.5.4 the investor must have subscribed for new shares for commercial reasons on arms' length terms (buying existing shares from another shareholder will not suffice).

3.6 Importantly, neither the investor nor anyone connected with them (such as family members) can have been a paid officer or employee of the business. However, a role as an unpaid non-executive director or 'business angel' is allowed.

3.7 Planning for IR will normally be less intrusive to the business than ER, requiring fewer changes to the business structure. Nevertheless, the business' key legal framework and contracts should be reviewed to deliver the maximum value possible on sale.

Timing

3.8 Because IR requires no minimum shareholding or voting rights, the relief allows for more flexibility in terms of timing. For most businesses, there will therefore be no need to carry out any extensive restructuring to secure IR, so this does not need to be addressed at the outset.

3.9 However, the requirement for investors to have held their shares for at least three years means that investors should not be planning for IR in the approach to an imminent exit. IR is best considered and secured as early as possible and before the investment is made.

4. Enterprise Investment Scheme (EIS)

Case Study

4.1 Mr Adams is a successful high-net worth investor who is looking to invest in high-risk businesses. He does not intend to play any active part in the business and is happy to put his capital at risk. He expects to receive a significant income tax bill this year and he has also recently made some capital gains on another investment, which he is happy to reinvest.

4.2 Mr Adams should consider investing in a business which qualifies for EIS. By doing so, he can reduce his income tax liability for the year and also defer any tax due on his existing capital gains. If the business is a success, any future capital gains he makes when he sells out would be fully exempt from capital gains tax.

The Relief

4.3 EIS relief is an approved tax incentive which is designed to promote early stage equity investment in trading companies. The EIS regime is more highly regulated than ER and IR and care must be taken, both from the point of view of the individual investor and the business, to claim the relief successfully.

4.4 A successful EIS structure provides the following valuable tax reliefs for investors:

4.4.1 provided they hold their investment for at least three years they may deduct an amount equal to 30% of the money invested from their total UK income tax liability for the tax year, up to an annual limit of £1 million (or £2 million in the case of knowledge intensive companies, such as those whose trade mainly involves the development of intellectual property/software);

4.4.2 if the above income tax relief is secured, any capital gain made on the disposal of the business is exempt from capital gains tax;

4.4.3 if the business is sold at a loss, relief is given for any losses (less any income tax relief already secured) which can be used against either income profits or chargeable gains; and

4.4.4 capital gains tax otherwise due on the disposal of other assets may be deferred by investing the proceeds in an EIS business.

Planning ideas

4.5 The above EIS tax reliefs can be extremely valuable for investors, especially because EIS can be used in tandem with ER and IR.

4.6 For example, if an entrepreneur sells an existing business which is eligible for ER, they can defer the tax charge on the sale by investing in an EIS business (as described at 4.4.4 above). The entrepreneur may then claim the EIS income tax deduction on making the investment (see 4.4.1) and any future growth in the EIS business would then be exempt from capital gains tax on a sale/IPO (4.4.2). The original gain from the sale of the entrepreneur's business with ER is then only brought into tax when they eventually sell their subsequent EIS investment, when it comes back into charge at the reduced 10% ER rate.

4.7 Given the value of EIS tax reliefs, the conditions which must be met to secure EIS treatment are stricter than for ER and IR. Bespoke legal advice should always be sought by each investor or business looking to secure EIS, but broadly the following conditions must all be met:

4.7.1 the investment must be made into a 'new' business (generally less than seven years old);

4.7.2 the business must have no more than £15 million of gross assets before any investment is made (and no more than £16 million of gross assets afterwards) and it must have fewer than 250 full time employees (or 500 for knowledge intensive businesses);

4.7.3 the investor and their associates must not be connected with the company (for example they cannot have previously been an employee or director of it) and they cannot hold a stake of more than 30%;

4.7.4 the investor must pay cash for new fully paid up ordinary shares, which must not carry any preferential rights on a winding up or redemption;

4.7.5 the shares must be issued for genuine commercial purposes and must not be listed on certain stock exchanges (though shares traded on AIM are acceptable);

4.7.6 the business must use the cash raised by the EIS investment for the purposes of its trade and it must not be a subsidiary or under the control of another company;

4.7.7 if the company receiving the EIS investment is the parent of a corporate group, it must own at least 50% of any subsidiary and the group must be a trading group (if the trade is carried on by a subsidiary then the minimum ownership threshold increases to 90%);

4.7.8 the business must carry on a trade which is taxable in the UK (though it can also trade outside the UK) and which does not include a substantial amount of financial services, property development or anything which involves bought-in intellectual property;

4.7.9 the investor must be exposed to a genuine risk of losing their capital and the business must grow organically, rather than by acquiring other businesses;

4.7.10 the business cannot raise more than £5 million under EIS (or any other corporate venturing scheme such as SEIS (discussed below) or Venture Capital Trusts) over a 12 month period, unless the business is "knowledge intensive" in which case the annual limit is £10 million; and

4.7.11 the investor cannot invest more than £1m in EIS businesses each year (£2m for knowledge intensive companies) and they have a total lifetime investment limit of £10m.

4.8 Because EIS should be considered as early as possible near the start of the business, structuring for EIS will also create the opportunity to structure the business more generally for success. For example, template commercial contracts, employment arrangements and IP structures can be put in place at the outset and the company's Articles of Association and Shareholders Agreement can be prepared so as to maximise value on sale.

Timing

4.9 Given the strict and technical nature of the above EIS conditions, they should be considered at the earliest possible stage of a business' life and with expert professional advice. By getting EIS right at the outset, a business can be made significantly more attractive to potential UK investors, who will be able to secure some extremely valuable personal tax reliefs.

4.10 If EIS is unavailable because not all the required conditions can be met, investors could consider whether it may be possible to simulate some of the benefits of an EIS investment with special share classes, such as growth shares.

5. Seed Enterprise Investment Scheme (SEIS)

Case Study

5.1 Mr Adams' sister, Ms Adams, has had similar success with her investments. However, she has a greater appetite for risk and is looking for even higher risk investments than her brother. She does not intend to play any active part in the business and is happy to put her capital at significant risk by investing in start-ups.

5.2 Ms Adams should consider investing in a business which qualifies for SEIS. By doing so, she can reduce her income tax liability for the year in the same way as Mr Adams, but to an even greater extent. Ms Adams can also extinguish any existing capital gains tax charge she may otherwise face by reinvesting the profits into a SEIS business and she will benefit from complete tax exemption from any further gain she makes in the future when selling her SEIS investment.

The Relief

5.3 As its name suggests, SEIS is a form of EIS which is targeted at even smaller (and riskier) start-up businesses than EIS, but which offers even greater tax reliefs.

5.4 A successful SEIS structure provides the following tax reliefs for investors:

5.4.1 provided the investment is held for at least three years they may deduct an amount equal to 50% of the sum invested from their total UK income tax liability (up to an annual investment limit of £100,000);

5.4.2 any unused annual investment limit may be carried back and used in the previous tax year;

5.4.3 if income tax relief is secured, any subsequent capital gain on the disposal of the business is exempt from capital gains tax;

5.4.4 if the business is sold at a loss, relief is given for any allowable losses (less any income tax relief secured) against either income or chargeable gains tax; and

5.4.5 capital gains tax otherwise due on the disposal of any asset may be exempt from tax if the gains are reinvested in SEIS shares.

Planning ideas

5.5 SEIS has similar features to EIS, and so many of the requirements are the same or similar. The key conditions for SEIS that differ from the EIS regime are as follows:

5.5.1 immediately before the investment the total value of the company's assets must not exceed £200,000;

5.5.2 at the time of the investment the business must have fewer than 25 full time equivalent employees;

5.5.3 the business cannot have raised more than £150,000 under the SEIS in the three years before the investment; and

5.5.4 the business must not have previously raised money under the EIS (or certain other tax-advantaged investment schemes);

5.6 SEIS needs to be addressed at the very start of a business, creating an early opportunity to structure the business for success. However, a business can follow a SEIS share issue with further issues of shares under EIS and investors can benefit from both schemes. So if investors are too late for a SEIS investment (for example because the business has grown too big), EIS may still be available.

Timing

5.7 SEIS needs to be addressed at the earliest stage of a business, often at inception. The strict rules around the scheme means that an investor can only claim relief if they are given a compliance certificate from the company, which requires prior authority from HMRC. This can potentially draw out the timeline of the investment.

6. Business Investment Relief (BIR)

Case Study

6.1 Ms Connor has recently moved to the UK but was born overseas and does not intend to stay in the UK over the longer term. She is not domiciled in the UK and claims the remittance basis of tax (so that she is only taxed in the UK on income and gains arising from the UK and not overseas).

6.2 Ms Connor recently sold her previous home outside the UK and has kept the proceeds in a non-UK bank account. A contact has identified a good investment opportunity in a UK company and Ms Connor would like to invest some of the sale proceeds from her house into the business.

6.3 She has previously been told that bringing the sale proceeds into the UK could trigger a UK tax charge as a 'remittance'. However, if Ms Connor can benefit from BIR, this tax charge would not arise and she could bring the proceeds into the UK tax-free to make the investment.

The Relief

6.4 BIR is available to non-UK domiciled individuals who claim the remittance basis of tax. Broadly, the relief enables them to invest funds from overseas in UK private companies without incurring tax charges on bringing the funds into the UK. Combining BIR with the tax reliefs covered elsewhere in this note can be a powerful combination for non-domiciled individuals, potentially enabling both the initial investment and any capital growth to be realised tax-free (or subject to minimal tax).

6.5 Historically, BIR was not used as frequently as intended because it came with some stringent conditions. However, recent changes to legislation have relaxed the conditions so that the relief can be used more easily. Since these changes, BIR can be obtained with either an equity or debt investment (though only equity investments would be able to benefit from the other tax reliefs and incentives covered in this note) and equity investments may be made by both share transfers and share subscriptions.

6.6 Investments in fully listed companies, partnerships (including limited liability partnerships (LLPs)), and sole traders are excluded from the relief. But otherwise most investments into private companies which trade in the UK (or which hold companies that trade in the UK) can qualify for BIR.

Planning ideas

6.7 A BIR investment need not necessarily be made by the taxpayer themselves – it could be made by a relative or investment vehicle controlled by the individual. For example, if the individual has a Family Investment Company (FIC), they may wish to channel the new investment through that company. Investing in this way would still qualify for BIR just as if they had made the investment themselves, providing greater flexibility for structuring.

Timing

6.8 BIR can be accessed at any time during the lifespan of a company and there is usually no need to specifically structure a business to qualify for the relief. However, it will be crucial for investors to obtain proper legal advice and tax analysis of the proposed investment before bringing the funds into the UK. This is because the BIR investment must be made within 45 days of the funds being brought into the UK in order to avoid triggering a remittance tax charge.

6.9 On exit, the proceeds must either be removed from the UK or reinvested in another BIR company within 45 days to avoid triggering a remittance tax charge.

If you require further information please contact James Bromley or your usual contact at the firm on +44 (0)20 3375 7000.

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, May 2018