PISCES: a new regulatory framework for trading in private company shares

Insight

As part of its wider agenda to reinvigorate capital markets, the Government is progressing the Private Intermittent Securities and Capital Exchange System (PISCES), a new regulatory framework that will facilitate trading in existing private company shares. It will provide a framework to allow private companies to trade their securities in a controlled environment and on an intermittent basis.

It is intended that PISCES will improve liquidity for early stage investors and others who hold shares in private companies, including employees. This is intended to reduce the burden of extensive due diligence in private company share transactions and facilitate share trading without the full disclosure processes that go alongside listing and operating a public company.

The Treasury will establish PISCES under a financial market infrastructure (FMI) sandbox to be implemented and overseen by the FCA for a period of five years. Over the five-year sandbox period, firms wishing to run a PISCES platform will need to seek approval from the FCA, and those involved in trading on a PISCES platform will be subject to modified UK regulation under the sandbox regime. Learnings from the PISCES Sandbox will then inform the infrastructure of the permanent regime.

The Government has indicated that the necessary secondary legislation to establish the sandbox will be published in May 2025. The FCA is separately consulting on its proposed operating arrangements for the PISCES sandbox. The final FCA rules are also expected in May, and it is anticipated that the first auctions may be run as soon as the end of 2025.

In this briefing we provide an overview of the proposed new regulatory regime and how we expect the system to work in practice.

Treasury rules

In November 2024, the Treasury published a draft SI, Policy Note and consultation response relating to PISCES. The consultation response sets out the broad features and operative provisions of the PISCES Sandbox.

- It will operate as a secondary market only, facilitating the trading of existing shares in intermittent trading windows. It will not facilitate capital raising through the issuance of new shares. In this initial stage, companies will not be able to complete buybacks through PISCES, but it is something that the Government is willing to explore at a later stage.

- Only shares in companies whose shares are not admitted to trading on a public market (in the UK or abroad) can be traded on PISCES.

- PISCES operators (that is, those firms that apply to run a PISCES platform) will shape the admission requirements for their markets. This includes corporate governance requirements.

- Only institutional investors, employees of participating companies and investors who can meet the definition of high net worth individuals and self-certified or certified sophisticated investors under the Financial Promotion Order (FPO), will be able to buy shares on PISCES.

- PISCES will not include a public market style market abuse regime. However, the FCA will have powers to create a new and bespoke disclosure regime for PISCES. Under this regime, disclosures and pre- and post-trade transparency information must be shared with all investors participating in a PISCES trading event, but will not have to be made public.

- As there is no market abuse regime, there will be no transaction reporting requirements for PISCES.

- There will be a new Financial Promotion Order (FPO) exemption to cover PISCES disclosures, based on the exemptions available for promotions included in mandated public market disclosures.

In the Autumn 2024 budget, the Chancellor announced that PISCES transactions will be exempt from Stamp Duty and Stamp Duty Reserve Tax.

FCA rules

On 17 December 2024, the FCA published Consultation Paper CP24/29 on its proposed rules and guidance for the PISCES Sandbox. The FCA may make further changes once the system is operational, and notes that it is not under a duty to consult on these.

The FCA’s stated aim is to ensure that the regime is attractive to companies and other participants, while limiting the risk of potential harm to those trading through appropriate and proportionate rules and protections.

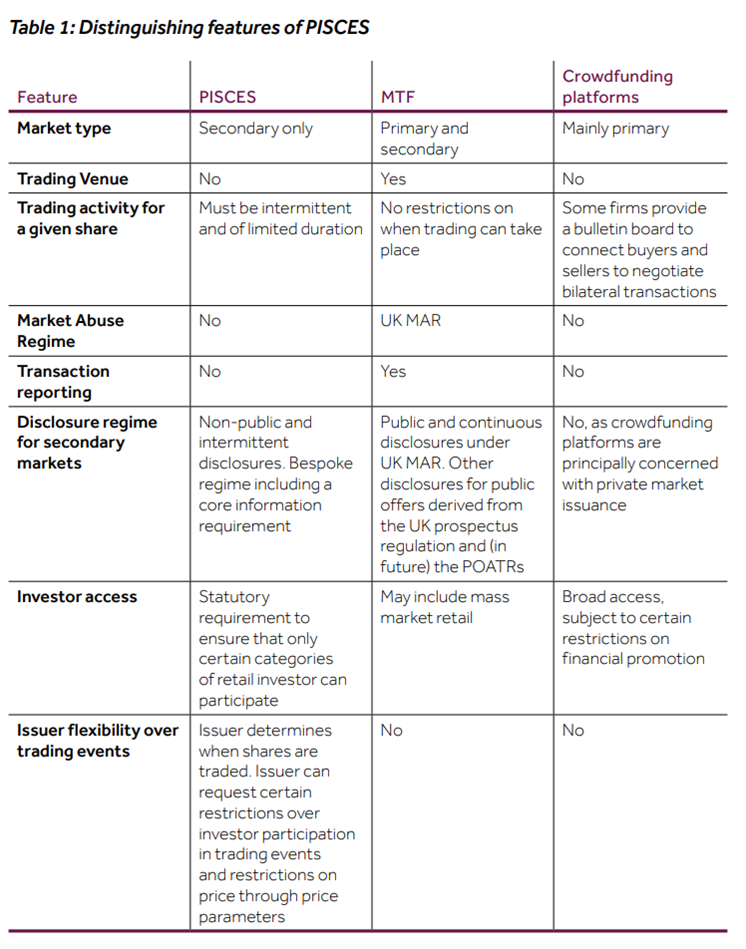

The FCA includes a useful comparison table of the PISCES features which differentiate it from multilateral trading facilities and crowdfunding platforms. Table from FCA Consultation Paper CP24/29

Table from FCA Consultation Paper CP24/29

PISCES will combine certain public market features, such as multilateral trading, with private market elements, including fewer compliance and disclosure obligations. This will give companies greater discretion over how and to whom their disclosures are distributed, when trading occurs, and which investors can participate in their trading events. As noted above, mass-market retail investors will not be able to trade on PISCES platforms.

The FCA consulted on a standalone sourcebook for the PISCES Sandbox which contains the proposed new rules and guidance for the regime.

The FCA’s consultation closed on 17 February 2025 and its final rules are due in May 2025. We will continue to monitor developments in this area.

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, March 2025