For Profit, For Good

Insight

A millennial makeover is influencing philanthropreneurs and impact investors. Traditionally philanthropy was seen an activity for those in the autumn of their lives. The received wisdom was that people would work hard and make their money, and then, later in life, give a decent slice of it away.

Not any more. Philanthropy is getting younger. The complex array of social issues dominating our lives is producing shifts that may be subtle rather than seismic, but are nonetheless profound. Likewise, in philanthropy’s close cousin, social impact investment. Younger voices are strongly influencing the direction of travel.

The rise of the philanthropreneur

Many of today’s socially aware philanthropists are determined to give in a strategic, targeted way. It is no longer a case of writing a cheque and disappearing over the horizon; instead, ‘philanthropreneurs’ have emerged – active donors who use the entrepreneurial skills they have harnessed to make their own fortunes for charitable causes and the public good.

Among the most entrepreneur-philanthropists are Bill and Melinda Gates. The Gates Foundation has a simple, yet powerful mission statement: ‘All lives have equal value – we are impatient optimists working to reduce inequity’.

Now, more than ever, philanthropy is under the spotlight. How money is made is increasingly seen as inseparable from how it is given away. Private assets can still be deployed for the public good.

Networks and trusted advisers, including lawyers, tax and philanthropy advisers, private bankers and trustees, are vital to help navigate the global cross-border issues facing philanthropreneurs. A checklist for success for today’s philanthropreneur might include:

- A motivation to make life better for others

- Giving money or time – or both – is a prerequisite

- Embracing the creativity and using skills that have helped the entrepreneur to make money to solve other people’s problems

- Leading from the front, and leading by example – being hands-on comes with the territory of philanthropreneurship.

This ethos is being mirrored in social impact investment, where investors seek a financial return alongside making a difference in particular areas, for example businesses with social and environmental products, or those that promote gender equality and diversity.

These things matter to millennials, who, according to research by JPMorgan Private Bank, will inherit $30tn in assets from their parents by 2025. What to do with all that money? For many, the answer is to invest ethically, and invest sustainably: the same JPMorgan research revealed that sustainability was a priority for 86% of millennials. Investors as a whole are not far behind: the Global Impact Investment Network (the GINN) says that 65% have a vested interest in making the world a better place.

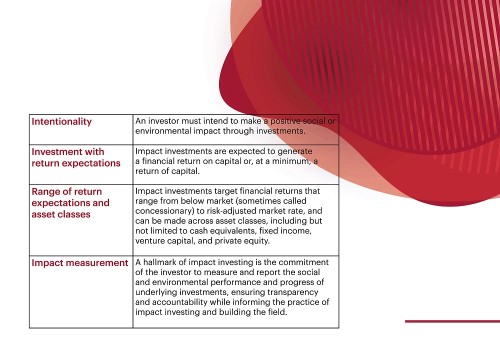

In April this year, the GINN - which estimates that the current size of the impact investing market is $502bn – published its guide to the Core Characteristics of Impact Investing. They are:

Those attracted to impact investment are not just family offices and foundations but also include banks, pension funds, financial advisors and wealth managers – all of whom are keen to demonstrate empathy with the Next Gen who are determined to invest with care and thought, with a view to making the world a better place while also generating financial returns. For them, it’s for profit, for good.

How green is your business?

Ethical investment is here to stay not just because of the influence of millennials, but because it is increasingly quantifiable and measurable.

Environmental, Social and Governance (ESG) criteria now used by socially motivated investors can provide just those measures. ESG criteria are readily available through brokerage firms and mutual funds, and their availability helps trustees balance their fiduciary duties with picking the right investment, both in terms of the portfolio and with regard to reputation management. It is easier now to assess things like a company’s environmental stewardship, the conditions its workforce operate in and the transparency of its accounting practices – things that are now seen as crucial in their own right but which can negatively impact both business and investor. Software can track and verify ESG performance; capital can be value-aligned.

Family Impact

Not only is social impact investment good for business, it is good for families, too. Many family offices will experience moments of tension, as younger family members sit across the table from the original wealth creators. Social impact investing breaks down these barriers and helps create a dialogue between generations. This may explain one aspect of the 2019 Sunday Times Rich List. According to the Sunday Times, a record £3.75bn was given to charity by Rich Listers in the 2019 List, but there was also a drop in the numbers giving away more than 1% of their wealth – down to 72 from the preceding year’s total of 86. It is possible that the Sunday Times’ drop is because a proportion of the philanthropists of yesteryear have replaced outright giving with social impact investment.

It is also likely that their commitment to sustainability starts at home. Green investors will be green in their own lives, and they’ll look for businesses which reflects their values.

Those businesses, especially start-ups, will need private capital flowing into them, structured as effectively as possible and taking account of multi-jurisdictional, legal and regulatory matters. Thanks to the millennial makeover driving the approach of both philanthropreneurs and social impact investors, the good news is that sustainable businesses are here to stay.

If you require further information about anything covered in this briefing, please contact David Fletcher, or your usual contact at the firm on +44 (0)20 3375 7000.

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, January 2020