How to lend to Trustees

Insight

In most respects, lending to trustees raises the same issues, and can be treated in the same way, as lending to any other kind of borrower. However, there are legal and practical issues which can catch out the unprepared.

Below we summarise the key issues and potential pitfalls a lender should bear in mind when lending to trustees and advise on what to do about them. This article only considers trustees of private trusts, not charitable ones.

Identify your borrower

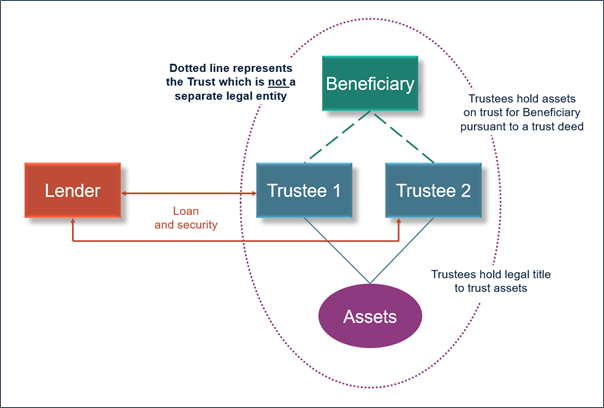

When dealing with trustees, lenders often think of the trust itself as their client, and therefore as their borrower. While this is a useful shorthand in practice, it is not actually the legal position. A trust does not have its own legal personality (unlike a company or an LLP), it is ultimately a description of a relationship which exists between the trustees, the trust assets and the beneficiaries. As a trust does not have legal personality, it cannot own any assets, enter into obligations or bring court proceedings. It is the trustees that hold identifiable assets on the terms of, or incur liabilities for the purposes of, the trust, only doing so for the benefit of (and in what the trustees consider to be the best interests of) the beneficiaries. Trustees may be individuals or corporate bodies. A “trust corporation” has a special status under English law which, among other things, enables it to act as a sole trustee. The assets held by a corporate trustee do not appear on that corporation’s balance sheet as they do not belong beneficially to the corporation.

Any lender seeking to “lend to a trust” must therefore identify the current trustees of that trust as it is they who will be party to, and will sign, the documents. This is not always as straightforward as it seems. The original trust deed establishing the trust will appoint one or more trustees, but these may have changed and in some cases none of the original trustees may remain in office. A lender or their lawyers must obtain copies of any deeds of appointment or retirement to establish who the trustees are at the time of the loan. Lenders may seek additional comfort by asking the trustees signing the loan agreement to represent that they are the current and only trustees of the trust.

A trustee will usually make it clear that they are acting “in their capacity as trustee” when signing an agreement. However, in the absence of a specifically agreed limitation provision (see below), under English law that trustee is personally liable for those obligations. So, given that risk, why would anyone ever act as a trustee? Well, provided the trustee has acted in accordance with the powers set out in the trust documents and provided the trustee has not incurred the liability through their misconduct, the trustee will be entitled to be indemnified for that personal liability out of the trust assets. So, while a lender to a trustee has access to the trust assets, it only does so indirectly through the trustee (unless the lender takes security over those assets and that security is granted by the trustees properly in accordance with the terms of the trust). A lender would always be well advised, therefore, assuming security is possible, to take security over all or some of the trust assets for this reason.

Check powers and authority

Trustees have fiduciary duties to act in the best interests of the beneficiaries of the trust and may be subject to specific restrictions under the trust deed relating to, for example, the purposes or the amount of any debt. Additionally, the trustees may only be permitted to grant security over trust assets in certain circumstances or with the consent of a named person, often called the protector. Trustees only have restricted powers to borrow under general English law and these will usually be expanded by the trust deed.

A lender’s lawyers will need to review the trust deed and any subsequent amendments to ensure that the trustees have the appropriate powers and will not breach the terms of the trust when they take on the obligations in the facility and security documents. As noted above, a trustee who is acting in breach of trust will not be entitled to indemnification out of trust assets, and this could be seriously detrimental to a lender’s interests if the trustee does not have sufficient resources of its own to meet its obligations. Again, lenders may seek the comfort of a representation from the trustees (or in some cases may require a legal opinion) confirming the trustees have the requisite powers and authorisation, especially if the trustees are incorporated overseas or if a foreign law governs the terms of the trust. In any case, lenders should always insist on seeing a unanimous resolution of all the trustees approving the documents and the transaction. The fact that such a resolution has been passed will normally demonstrate that the trustees have considered their fiduciary duties.

Consider regulatory aspects

A further consequence of lending to the trustees of a trust is that the lender should consider whether the credit with be a regulated credit agreement or a regulated mortgage contract within scope of the UK’s regulatory perimeter. If it is, the lender will either need to have the appropriate authorisation and regulatory permissions or be able to rely on an available exemption. Failure to meet these requirements risks the lender committing a criminal offence and the agreement itself being unenforceable against the borrower. Even where the lender does have the relevant regulatory permission unless an exemption applies, the lender will need to comply with the detailed documentary and procedural formalities for such agreements. In the case of a regulated credit agreement, a failure to get the formalities right risks the agreement being unenforceable against the borrower without an order of the court.

Given the complexity and risks for the lender associated with entering into regulated agreements some lenders will only be willing to make a loan available to trustees in circumstances where they are able to apply an available exemption. The most commonly applied exemptions when lending to the trustees of a trust are those available where the credit will be used for business purposes (for both regulated mortgage contracts and regulated credit agreements) or, in the case of an otherwise regulated credit agreement, the high net worth exemption. There are strict conditions which must be complied with in order to rely on those exemptions and we recommend advice is taken before lenders seek to rely on such exemptions.

Consider including limited recourse provisions

Given that a trustee is personally liable for any contracts entered into, even in accordance with the terms of a trust, trustees run the risk that the realisable value of those assets may not be sufficient to meet the obligations owed, particularly where trust assets may fall in value. Most trustees, and nearly all professional trustees, will therefore request the inclusion of a limited recourse clause in any contract they enter into “as trustee”, including facility and security documents, and may well refuse to enter into the arrangement at all if an adequate clause is not included. Under a typical limited recourse or other limitation of liability clause for trustees in a financing context, the relevant counterparty to the contract agrees that their ability to recover the debt owed will be limited to the value of the trust assets. The clause may also expressly exclude the trustees from any personal liability whatsoever. Limited recourse wording is particularly important should one or more of the trustees retire, because they will remain jointly and individually liable to the lender for any debt incurred while in office even after retirement. That is unless they have obtained a specific release from the lender but, for the reasons set out in the next section, may struggle to access the trust assets should the lender seek to recover the debt from them.

Any limited liability or recourse provisions should be considered on a case-by-case basis. If a provision is accepted whereby a retiring trustee is released from liability, the lender must be particularly careful to ensure that any release is dependent on there being at least one (often two) continuing trustees. A lender will only want to limit recourse to trust assets where it has sufficient comfort as to their value and that there are controls in place (often through the grant of security) to prevent the trust assets from being dissipated. As any limitation clause is always construed carefully by the courts and must be reasonable if it is to be upheld, trustees should take legal advice to ensure that they do not seek to exclude liabilities for matters (such as their own fraud) which, as a matter of public policy, the courts will never enforce and which might cause the whole provision to fail.

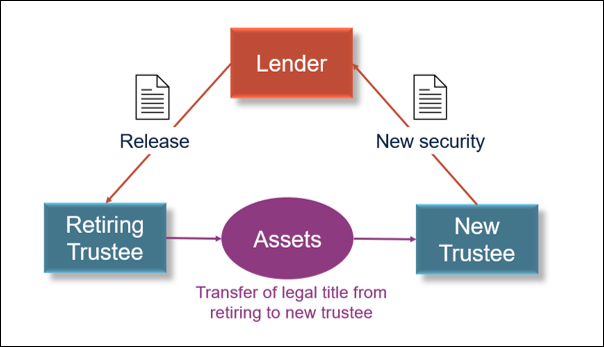

Plan for changes to trustees

As trustees are the legal owners (in some circumstances through a custodian or nominee) of the trust assets, any new appointments or retirements must be accompanied by a transfer of title to or from the new or retiring trustees. This creates problems for lenders who have lent money and taken security from the existing trustees. The security itself will usually survive any transfer, but the lender will not have a contractual relationship with the new trustee under which, for example, the trustee agrees to maintain or insure the relevant trust assets. In addition, while former trustees still have a right to be indemnified out of the trust assets, once they have passed title to those assets to the new trustee the retired trustee will, at least to some extent, have to rely on the new trustees to maintain the value of, and ultimately realise sufficient money from, those assets to meet that indemnity. This may be challenging if relationships have broken down or if there have been several changes of trustee over time and presents a risk to creditors of such former trustee.

There are different ways to address this issue. When using short form standard documents, lenders may find it cheaper and easier to replace all the loan and security documents with new ones to be signed by the new or replacement trustees. Where using longer form bespoke documentation it may be more efficient for lenders to build accession and retirement mechanics into their loan and security documents so that any new trustee can sign a short accession deed rather than a new suite of documents. In any case it is sensible for lenders to make any changes to the trustees an “event of default” or mandatory prepayment event under the loan agreement so that, in practice, the lender’s consent will be required, giving it the opportunity to insist on new or amended documents.

Trustees are also likely to prefer that any agreement caters for changes in trustees, whatever the reason (eg a voluntary change to allow for retirement or involuntary, such as where a trustee dies) because in the absence of a mechanism to change the counterparties to the contract, those trustees who originally entered into the agreement will remain liable under it, as will their estates if they have died.

Conclusion

While lending to trustees of private trusts does raise additional issues for lenders, with appropriate advice from lawyers who have expertise both in lending arrangements and trusts, nearly all of these can be relatively easily resolved by carrying out careful due diligence on the trust documents and on title to the trust assets, as well as appropriate drafting of the lending documents.

If you require further information about anything covered in this briefing, please contact Simon Graham, Ben Parish or your usual contact at the firm on +44 (0)20 3375 7000.

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, November 2022