Sustainable Finance: an overview of the European Commission's proposals (October 2019)

Insight

We have produced a further update on sustainable finance, as at 8 September 2020, which you can view here. The new update covers the now implemented Taxonomy and Disclosure regulations that are detailed below and were proposals at the time of this article.

In the wake of Greta Thunberg’s address to world leaders at the UN Climate Action Summit this September and as Extinction Rebellion protests take place again in London this month, climate change and sustainability are never far from the headlines. In this article, Grania Baird and Kya Fear consider the proposals by the European Commission (EC) to put Environmental, Social and Governance (ESG) considerations at the heart of the financial system.

A number of our clients implement sustainable finance strategies such as negative screening, best in class, ESG integration and impact-driven investment on a voluntary basis. However, the EU proposals, if adopted, will require MiFID II investment firms, UCITS management companies, AIFMs, EuVECA and EuSEF managers to make changes to ensure that consideration of ESG factors and risks are part of their processes. Those firms which manage or market financial products or services with a “sustainable” target or investment strategy will, unsurprisingly, be most impacted.

Why is the EC proposing measures, including new regulations, regarding sustainable finance?

The EU has stated that it strongly supports the transition to a low-carbon, more resource-efficient and sustainable economy and wants to be at the forefront of efforts to build a financial system that supports sustainable growth.

In October 2014, the EC set an ambitious economy-wide domestic target of at least 40% greenhouse gas emission reduction for 2030 (as compared to the levels in 1990), as well as renewable energy and energy efficiency targets of at least 27% (2030 Framework).

After setting this target, two landmark international agreements were reached – the Paris Climate Agreement and the UN 2030 Agenda and Sustainable Development Goals. In particular, the Paris Climate Agreement includes a commitment to align financial flows toward low-carbon and climate-resilient development.

The EU sees the Paris Climate Agreement as an opportunity to exploit first mover advantage when fostering renewable energy, energy efficiency and globally competing on developing low carbon technology. To reap the benefits, the EU said it needs to lead by example and take action on regulatory policies to reduce emissions and enable factors that accelerate public and private investment in key sectors. To implement the 2030 Framework, the EC has to fill an investment gap estimated at €180bn per year, which is beyond the capacity of the public sector alone. The EC sees reforms for sustainable finance as necessary to, amongst other things, support investment in clean technologies and their deployment.

What is “sustainable finance” and its impact on the financial sector?

The EC currently describes “sustainable finance” in the context of EU policy as the provision of finance to support economic growth while reducing pressures on the environment and taking into account social and governance aspects. The EC also considers that sustainable finance encompasses transparency on risks related to ESG factors that may impact the financial system, and the mitigation of such risks through the appropriate governance of financial and corporate factors.

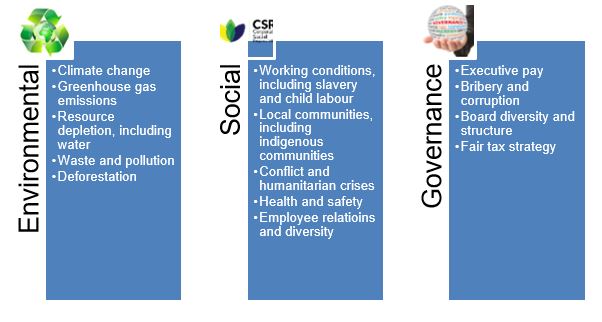

What are ESG factors?

ESG is frequently referred to – but what is covered within ESG? The table below contains a helpful summary:

Source: UNPRI

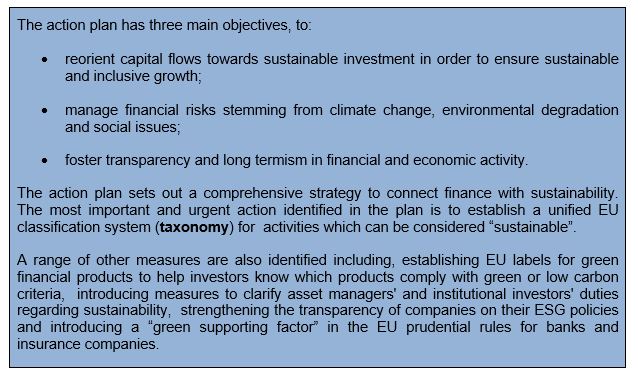

What is the EU’s action plan concerning sustainable finance?

In January 2018, a High-Level Expert Group on Sustainable Finance (HLEG) appointed by the EU, published a report offering a sustainable finance strategy for the EU. Their recommendations formed the basis of the action plan on sustainable finance adopted by the EC which was published in March 2018.

How is the action plan being implemented?

In May 2018, the EC presented a package of measures implementing several key actions announced in the action plan including:

- a proposal for a regulation on the establishment of a framework to facilitate sustainable investment (Taxonomy Regulation);

- proposal for a regulation on disclosures relating to sustainable investments and sustainability risks and amending Directive (EU) 2016/2341 (Disclosure Regulation); and

- a proposal for a regulation amending the benchmark regulation.

In addition, the EC has consulted on two draft Delegated Regulations which amend Delegated Regulations made under the MiFID II Directive (2014/65/EU) and the Insurance Distribution Directive ((EU) 2016/97).

In this article, we refer to the draft Delegated Regulation amending Regulation (EU) 2017/565 which supplements the MiFID II Directive as regards organisational requirements and operating conditions for investment firms and defined terms (the MiFID Org Regulation) as the “MiFID II Delegated Regulation”.

What does the draft Taxonomy Regulation do?

The Taxonomy Regulation is expected to provide clarity on what is “green”, facilitating investments in sustainable projects and assets across the EU to help contribute to the achievement of the EU’s goals agreed in the Paris Climate Agreement.

In its current draft form, the Taxonomy Regulation sets harmonised criteria for determining whether an economic activity is environmentally sustainable (rather than of companies or assets). The idea is that investors will know which economic activities are considered environmentally sustainable, which will then facilitate investments in sustainable assets. If Company A performs only environmentally sustainable activities, the investment in Company A is deemed environmentally sustainable. In contrast, if Company B performs several activities and only some are environmentally sustainable, Company B would have a different degree of sustainability to Company A.

A consistent taxonomy may help address “greenwashing”, where firms gain unfair competitive advantages through marketing financial products as environmentally friendly, but which in fact do not meet basic environmental standards. It would also support the Disclosure Regulation, requiring that those financial market participants who would be subject to the Disclosure Regulation disclose the degree of environmental sustainability of the financial products that financial market participants claim pursue environmental objectives.

What requirements would the Disclosure Regulation impose on firms?

The Disclosure Regulation aims to enhance transparency by requiring financial institutions to disclose how they integrate ESG risks in their investment decision-making and advisory process. Asset managers and institutional investors offering products or services marketed as sustainable will have to disclose how they achieve their sustainability targets.

The current draft of the Disclosure Regulation would impose a number of detailed requirements on a wide scope of firms, including MiFID II investment firms, UCITS management companies, AIFMs, EuSEF and EuVECA managers (Firms). For more information on the detailed requirements, see below.

A. Pre-contractual disclosures

A Firm would be required to disclose the following information before entering into a contract with a client:

- The applicable procedures and conditions for integrating sustainability risks in investment decisions.

- The extent to which sustainability risks are expected to have a relevant impact on the returns of the financial products made available.

- How its remuneration policies are consistent with the integration of sustainability risks and are in line, where relevant, with the sustainable investment target of the financial product.

- Where a financial product has as its target sustainable investments or investments with similar characteristics and an index has been designated as a reference benchmark, information on how the designated index is line with that target and an explanation as to why the weighting and constituents of the designated index aligned with that target differ from a broad market index. Alternatively, where a financial product has as its target sustainable investments or investments with similar characteristics, but no benchmark has been designated as a reference benchmark, an explanation as to how the target is reached.

- Where a financial product has as its target the reduction in carbon emissions, the information to be disclosed will include the targeted low carbon emission exposure. Additionally, where no EU low carbon benchmark or positive carbon impact benchmark is used, a detailed explanation of how the continued effort of reaching the target of reducing carbon emissions is ensured.

B. Disclosures in periodical reports

For each financial product that has as its target sustainable investments (or investments with similar characteristics), or the reduction in carbon emissions, a description of the following would be included in the relevant periodical reports of Firms:

- The overall sustainability-related impact by the financial product by means of relevant sustainability indicators.

- Where an index has been designated as a reference benchmark, a comparison between the overall impact of the financial product with the designated index and a broad market index in terms of weighting, constituents and sustainability indicators.

The relevant periodical reports being the annual reports of AIFMs, EuVECA and EUSEF managers; the half-yearly and annual reports of UCITS management companies; and the periodical reports of MiFID II investment firms.

C. Website disclosures

Firms would be required to publish certain information on their websites, including:

- Written policies on the integration of sustainability risks in the investment decision-making process.

- For each financial product that has as its target sustainable investments (or investments with similar characteristics), or a reduction in carbon emissions:

- A description of the sustainable investment target.

- Information on methodologies used to assess, measure and monitor the impact of sustainable investments selected for the financial product, including its data sources, screening criteria and sustainability indicators used to measure the overall sustainable impact of the financial product.

- Some of the pre-contractual disclosures described above.

- The periodical reports described above.

D. Marketing communications

Firms would need to ensure marketing communications do not contradict information disclosed pursuant to the Disclosure Regulation.

What requirements would the MiFID II Delegated Regulation impose?

The EC believes that to enable MiFID II investment firms to recommend suitable products to their clients, firms should introduce in their suitability assessment, questions that help identify the client’s individual ESG preferences. Further, in accordance with the obligation to act in the best interest of the client, recommendations by MiFID II investment firms to clients should reflect both financial objectives and the ESG preferences expressed by those clients. Finally, the EC noted that MiFID II investment firms should explain to their clients how their ESG preferences for each financial instrument are taken into consideration in the selection process used by a MiFID II investment firm to recommend financial products.

The MiFID II Delegated Regulation proposes amendments to Article 52 (information about investment advice) and Article 54 (assessment of suitability and suitability reports) of the MiFID Org Regulation.

With respect to information about investment advice, the proposed amendment to Article 52(3) of the MiFID Org Reg would require a MiFID II investment firm to include ESG considerations when providing a description of the factors taken into consideration in the selection process used to recommend financial instruments, where relevant, in addition to other factors already set out in Article 52(3) such as the risks, costs and complexity of financial instruments.

With respect to suitability, information regarding the investment objectives of a client would include a client’s ESG preferences, if any. MiFID II investment firms would need to obtain information from clients/ potential clients for determining that a specific transaction to be recommended or entered into in the course of providing a portfolio management service meets the client’s ESG preferences, if any. Further, MiFID II investment firms would need to have in place, and would need to demonstrate that they have in place, adequate policies and procedures to ensure that they understand the nature, features, costs, and risks of investment services and financial services selected for their clients, including ESG considerations where those are relevant.

What has the industry response to the proposed regulations been?

Industry bodies such as the Investment Association have sought clarifications from the EC on the proposed package of measures in respect of sustainable finance.

In particular, the IA has asked for clarity that the key purpose of the Taxonomy Regulation is to prevent “greenwashing” and to provide a framework to assist with disclosure, and is not itself a compliance exercise. Additionally, that the incorporation of ESG risks and opportunities into the investment decision making process per the Disclosure Regulation includes a holistic assessment of the economic viability of an investment, taking into consideration ESG factors and traditional financial analysis (the sole aim not being to fulfil ESG outcomes or targets).

Concerns have also been expressed around the mechanics of the process needed to carry out the proposed requirements in the MiFID Delegated Regulation – for example, it is unclear how MiFID II investment firms can ensure the necessary information flow where there are no rules to facilitate this on the part of the product manufacturer.

Finally, a number of industry bodies including the Alternative Investment Management Association and the European Fund and Asset Management Association, wrote a letter to the EC in September expressing concerns about the compliance challenges, liability risks for market players and confusion for investors which would be caused by the Disclosure Regulation becoming applicable before all the measures are adopted which clarify the understanding of the requirements, and which are seen as instrumental in ensuring the industry’s adequate and timely preparation for compliance with the new rules.

Next Steps

With respect to the Taxonomy Regulation, the European Council issued a press release at the end of September confirming it has agreed its position and negotiations between the European Council and European Parliament are ready to start. According to the European Council’s position, the taxonomy should be established by the end of 2021 to ensure its full application by the end of 2022.

With respect to the Disclosure Regulation, the Council has not yet adopted its position and the EC cannot adopt the MiFID II Delegated Regulation until the Disclosure Regulation has been agreed. As currently drafted, the main parts of the Disclosure Regulation would apply 15 months after publication in the Official Journal (OJ), however, as noted above, industry bodies have expressed their concerns about the Disclosure Regulation becoming applicable before all regulatory technical standards (RTS) are adopted and have urged the EC to take immediate action to ensure a “realistic time” for implementation, suggesting application should be one year following publication of all the RTS in the OJ.

In light of growing demands on governments to act on climate change, it is not surprising that reforms relating to climate change, including measures relating to sustainable finance, are high on the EU’s agenda. With more focus on sustainable finance, it is prudent for firms to keep a watching brief on this area to be ready to implement any changes to their investment processes when necessary in response to regulation and even consumer demand.

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, October 2019