UK Commercial property - Tax for the foreign investor

Insight

Bringing foreign investment into the UK residential property market within the scope of UK tax in 2015 may have been viewed by the government as a soft target. From April 2019 investors will have to consider the impact of UK taxes on investment into commercial property and the effect that has on overall returns.

This briefing considers the application of UK property taxes in as they apply to non-residential property at the point of purchase, during ownership and on eventual disposal.

On purchase - Stamp Duty Land Tax (SDLT) applies to properties situated in England and Northern Ireland. Scotland and Wales have introduced their own property purchase taxes which are similar, but not identical, to SDLT.

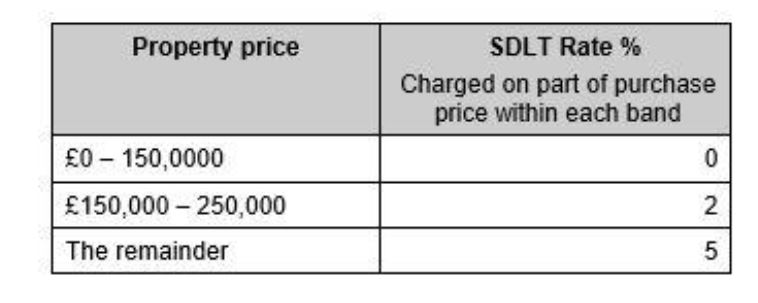

SDLT is paid by the buyer on the purchase price (including any VAT paid) at the following rates:

Value Added Tax (VAT)

VAT is an EU-wide tax on goods and services. A supply of real estate, whether it is a freehold or leasehold purchase, or the grant of a lease, is primarily exempt from the tax. However, in the UK it is charged at 20% in addition to the purchase price of property, if the person selling it has “opted to tax”. Exercise of the option to tax takes a property out of the exemption and makes any supply of it standard rated. A property owner will normally choose to opt to tax if any expenditure is to be incurred in relation to a property, because that enables the VAT input tax payable on the expenses to be recovered. It means that the investor landlord has to charge VAT on rents payable by lessees.

The supply of a commercial property will be outside the scope of VAT if it constitutes the transfer of a going concern (TOGC). This will be the case if the property is tenanted, or subject to an agreement for lease even if the prospective tenant has not yet gone into occupation. If the sale of the building will be a TOGC, then no VAT is chargeable by the seller – but an important condition is that the buyer is required to opt to tax with the result that any supply then made by the buyer is taxable.

If the supply of the property is not, for any reason, a TOGC so that VAT is chargeable, if the buyer opts to tax, the VAT incurred on purchase should be recoverable as input tax. The net cost would therefore be the carrying cost of funding the tax paid on purchase until it is repaid by HM Revenue and Customs (HMRC) or taken as a credit against VAT output tax.

Opting to tax, with the result that a property owner begins to make taxable supplies in the UK, means that the owner has to become UK registered for VAT purposes in order to account for the tax.

During the ownership period – Income Tax and Corporation Tax

UK income tax is charged on rents arising from UK property. If the property is held by an individual, the income tax rates in force at the time are applicable. Currently the highest rate (charged on annual income over £150,000) is 45%.

Non-UK resident companies also currently pay income tax at the rate of 20% on their UK rental income, whereas UK resident companies pay corporation tax (currently 19%). From April 2020 non-UK resident companies will be subject to UK corporation tax on their UK rental income, at which time the rate is expected to be 17%.

Certain expenditure associated with the property is tax-deductible, including maintenance and finance costs. This is partially restricted for individual owners.

A tenant paying rent to a non-UK resident (individual or company), or an agent who collects rents on a non-resident landlord’s behalf, are required to deduct and account for a 20% withholding tax on rents received. The liability to pay withholding tax is normally avoided by applying to HMRC to make use of the Non-Resident Landlord Scheme. The property owner then has to submit an annual tax return to HMRC and pay the tax, however it improves cash-flow.

Tax on rents will be calculated after deducting allowable expenses. The most significant of these is likely to be finance costs. Interest on loans to acquire a property can be deducted from income, but if it is payable to a related party then it needs to be at an arm’s length rate, and the amount of borrowing must not exceed what could have been borrowed from an unrelated party such as a bank. To the extent that the amount of interest paid exceeds either of those limits, interest should be disallowed in the tax computation.

Once non-UK resident companies are brought into the corporation tax regime in 2020, the corporate interest restriction rules will be in point. The aim of the rules is to restrict a group’s deductions for interest expense and other financing costs to an amount which is commensurate with its activities taxed in the UK, taking account of the amount the group borrows from third parties. The rules will not apply to groups with net interest expense of less than £2 million per annum and the expression ‘group’ for these purposes includes standalone companies.

Who the debt restriction rules apply to:The rules took effect from 1 April 2017 and apply to companies on a group-wide basis. For this purpose, the ‘group’ will include companies within the charge to UK corporation tax (including permanent establishments of non-resident companies). The definition of “group” is based on the accountancy concept of a group, so it includes the ultimate parent and all entities that are consolidated on a line by line basis in the parent’s consolidated financial statements. The expectation is that this will exclude associates and joint ventures.

How the rules work

The rules restrict a group’s deductions for interest (and other similar financing costs) to a ‘fixed ratio’ or a ‘group ratio’.

The fixed ratio rule restricts interest deductions to 30% of EBITDA taxable in the UK. A modified debt cap rule will ensure that the net UK interest deduction will not exceed the total net interest expense of the worldwide group.

The group ratio rule can allow a higher deduction to be claimed for interest expense. Under this rule, the group’s interest deductions are restricted based on the ratio of the worldwide group’s net interest expense to the worldwide group’s EBITDA. Interest payable to related parties is excluded from the group ratio rule.

Amounts of restricted interest can be carried forward without limit and used in later periods if there is sufficient interest allowance. Unused interest allowance can also be carried forward, but only for up to five years.

On disposal – Capital Gains Tax (CGT)

Capital gains tax is currently charged to all foreign owners of UK residential property, whether the property is held individually, through a trust or by a company.

From April 2019 non-UK residents holding UK commercial real estate will be subject to UK tax on their gains. This means that from that date almost all non-resident owners of UK land will be within the scope of UK tax on gains, including “widely held” investment funds. This brings the UK into line with most other tax jurisdictions and the theory that land should be taxed where it is situated.

The new rules will also apply to sales of interests in “property rich” vehicles – that is, entities that derive at least 75% of their gross asset value from UK land. Gains on disposal of any interest in such a vehicle amounting to 25% or more will come into charge to UK tax. Tax in respect of commercial property will only be payable on gains accruing after April 2019.

Property developers and traders

Rules relating to Transactions in UK Land were introduced in 2016, to counteract claims that a development or dealing trade is being carried on outside the UK, and therefore not subject to UK tax. Profits from a development project are therefore within the scope of income tax or corporation tax, depending upon who is carrying it on. These rules also apply where there are arrangements to sell the developer, rather than the land itself. They apply where shares (for example) are sold and they derive at least 50% of their value from UK land.

On death - Inheritance Tax (IHT)

UK residential property which is held directly has always been subject to UK inheritance tax on the death of the owner or on certain gifts, subject to certain exemptions and reliefs. From 6 April 2017, all UK residential property, whether held directly or indirectly, became exposed to this tax (with the exception of property owned by diversely held vehicles).

Commercial property held directly by an individual is similarly exposed to a UK IHT charge. There is, at the date of this briefing, no suggestion that commercial property held indirectly through a company or similar vehicle will give rise to an exposure to IHT, however the UK government may in time consider this to be the next logical step.

Some observations and conclusions

In the light of all the above changes:

- It is not now possible to carry on a trade of developing and dealing in UK land without the profits from the activity being exposed to UK tax.

- After April 2019 it will not be possible to avoid UK capital gains tax on real estate gains, however that real estate is held and whether or not the owner is UK resident. Serious consideration should be given to whether it is worth the cost of setting up or maintaining any offshore structure for property ownership.

- The traditional “Opco/Propco” structures designed so that land was owned by an offshore company to avoid capital gains tax, while the UK operations were managed through a UK company (for example, the approach adopted for hotel ownership) are already effectively redundant. Owning and operating through a corporate vehicle still confers protection from Inheritance Tax, however.

- A corporate vehicle, whether onshore or offshore is still advantageous where limited liability is required, particularly in the context of development projects. Moreover, acquiring a corporate vehicle still means that there is no 5% SDLT liability and instead only 0.5% is payable (if it is a UK company) or 0% (if it is a non-UK company being acquired or sold).

- There may be good non-tax reasons to opt for a trust, such as confidentiality, estate planning and asset protection. At the same time, increasingly onerous disclosure and compliance obligations demanded of offshore trusts and companies must be considered.Bespoke tax advice is critical. Investors who already hold UK property may wish to re-evaluate their position to assess their exposure to unnecessary tax or tax risk.

This publication is a general summary of the law. The law and rates of tax referred to are correct at June 2018. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, June 2018