UK Residential property - Tax for the foreign investor

Insight

During the past five years the UK residential property market has been the subject of much scrutiny by the media and from across the political spectrum. Recent governments have responded by implementing a plethora of measures. There are now higher taxes on prime real estate, in particular where the property is owned via a company. Exemptions enjoyed by foreign investors have gradually been withdrawn and a tax break for the average first-time buyer was introduced.

The changes in tax law have been fast and furious. Any investor, whether seeking to maintain their foothold in the UK market or venturing here for the first time, would do well to seek specialist advice.

This briefing provides a broad overview of UK residential property taxes as they apply at each stage: at the point of purchase, during the ownership period, and on eventual disposal via a sale, gift or on the death of the owner.

It is assumed throughout this briefing that the investor has a foreign domicile.

On purchase - Stamp Duty Land Tax (SDLT)

SDLT applies to properties situated in England and Northern Ireland. Scotland and Wales have introduced their own property purchase taxes which are similar but not identical to SDLT.

SDLT is paid by the buyer on the purchase price. For residential properties with a value of more than £1.5m this tax is a substantial initial cost which cannot generally be mitigated. A distinction is made between the purchase of an individual’s first or main residence and the purchase of an additional property.

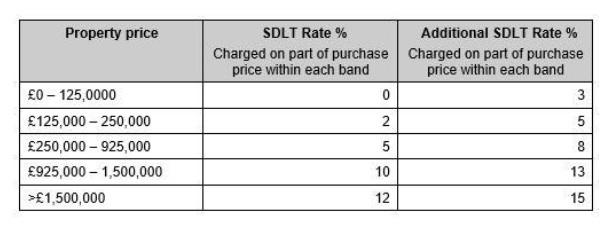

- The purchase of a property which will be the owner’s first or only residence (worldwide) and which is not acquired through a company, will be subject to the SDLT rates set out in the middle column of the table below. Partial exemption and a reduced SDLT rate of 5% applies to first time buyers of properties with a value not exceeding £500,000.

- For purchases of second or subsequent properties the “Additional SDLT” rates apply. These rates equate to a further 3% at each level (as shown in the right-hand column of the table).

To determine whether the Additional SDLT rates apply it is important to note that spouses and civil partners are treated as one unit, so if the husband owns a property, a purchase by the wife will attract the Additional SDLT rates and similarly for joint purchasers. Whether or not a purchase by trustees attracts the Additional SDLT rates will depend on the type of trust (discretionary or not) and (if not discretionary) whether the beneficiary is already a property owner.

Where a corporate acquires a residential property the SDLT rate of 15% is applied to the entire purchase price. This is subject to exceptions, for example where the property is acquired for development or to be rented to third parties, in which case the Additional SDLT rates will apply instead as per the right hand column above.

During the ownership period – Income Tax and ATED

UK income tax is charged on rents arising from UK property. Where the property is held individually, the income tax rates in force at the time are applicable. Currently the highest rate (charged on annual income in excess of £150,000) is 45%.

Non-UK resident companies pay income tax at the rate of 20% on their UK rental income whereas UK companies pay corporation tax (currently 19%). From April 2020 non-UK resident companies will be subject to corporation tax on their UK rental income, at which time the rate is expected to be 17%.

Certain expenditure associated with the property is tax-deductible, including maintenance and finance costs. This is partly restricted for individual owners.

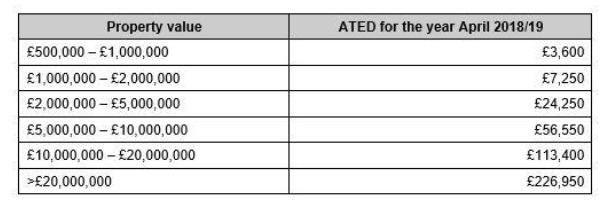

The Annual Tax on Enveloped Dwellings (ATED) is a tax paid every year by any privately held corporate entity which owns a UK residential property (including partnerships with a corporate partner and certain collective investment schemes). This tax applies whether the entity is UK or non-UK resident. It is levied on all residential properties valued at more than £500,000 at the amounts set out in the table below.

Reliefs from ATED are available, for example, a property which is let out to third parties or which is being redeveloped for sale may not be subject to ATED.

On sale or gift – Capital Gains Tax (CGT)

CGT is charged to all foreign owners of UK residential property whether the property is held individually, through a trust or by a close company. It is calculated by reference to the increase in the value of the property (“the capital gain”). Where a property which is not held by a company has been owned before 6 April 2015, it will generally be rebased to its value as at 5 April 2015 so that earlier capital gains are not charged on the disposal.

The rates of CGT are 18% or 28% for individuals (depending on total UK income and gains), 28% for trustees and 20% for companies. Where a company is subject to ATED (described above) the higher rate of 28% applies.

It is possible for foreign residents to claim relief from CGT where the property is occupied as their main residence. To qualify, the individual must satisfy the "day count test" by being in the property for at least 90 days in a tax year. For each tax year that the individual satisfies the day count test the gain on the property is relieved from CGT. The main residence relief may also apply where the property is in trust if a non-resident beneficiary is able to satisfy the day count test. By meeting the day count test, the individual risks becoming UK tax resident.

From April 2019, it is proposed that the CGT charge on UK residential property will be extended to all non-resident companies (other than most tax exempt vehicles) and will also become due on the disposal of shares in so-called “property rich” companies. A dedicated briefing on the new rules will be issued once draft legislation is published.

On death - Inheritance Tax (IHT)

UK residential property which is held directly has always been exposed to IHT on the death of the owner or on certain gifts. From 6 April 2017, all UK residential property, whether held directly or indirectly in effect, became exposed to this tax (with the exception of property owned by diversely held vehicles). This means that shares in closely held non-UK companies will be subject to IHT to the extent that their value is attributable to the UK residential property held by them (including when the company is owned through a trust). These rules also apply to loans used to buy, enhance or maintain the property.

On the death of the owner the value of UK property will be subject to IHT at 40% (save to the extent the spouse or charity exemptions or reliefs apply). Debt secured on the property can be deducted from this amount subject to certain conditions, for example the debt must be repaid after death, which in some cases may necessitate a sale. Except in the case of commercial borrowing, the debt itself may be subject to IHT.Property held in trust whether directly or indirectly is also exposed to IHT.

In the case of individual ownership, the property is rebased on the death of the owner. If the individual holds shares in the company that in turn owns the property, the shares are rebased (but not the property). The property held in trust is not rebased on the death of the settlor nor (usually) on the death of a beneficiary.

What to do – planning suggestions

The UK tax regime is intended to discourage corporate and indirect ownership of residential property. In most cases, individuals will therefore find it more tax-efficient to hold properties in their own name rather than through a company or trust. Personal ownership may provide access to the lower rates of SDLT, it avoids an ATED charge and is simpler in terms of administration. Offshore corporate and trust structures no longer provide protection from CGT and IHT.

Nonetheless, there continue to be circumstances where trust or corporate structures are appropriate. For example, properties which are acquired to establish a rental or development business may benefit from being held in a company (primarily because of the difference in tax rates between corporation tax and personal income tax). A corporate can also be advantageous where limited liability is required. In addition, there may be good non-tax reasons to opt for a trust, such as confidentiality, estate planning and asset protection. At the same time, disclosure and compliance obligations required of offshore trusts and companies may be unattractive.

Each individual’s circumstances and priorities are unique so bespoke tax advice is critical. Investors who already hold UK property may wish to re-evaluate their position to assess their exposure to preventable tax and compliance obligations.

This publication is a general summary of the law. The law and rates of tax referred to are correct at June 2018. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, June 2018