UK residential property structures: what are my options?

Insight

The tax treatment of residential properties has changed significantly over recent years. If you are looking to purchase a residential property in the UK, it is therefore crucial to consider the tax treatment as early as possible.

Many tax structures and vehicles which were previously popular may no longer be appropriate, and some taxes which were previously relatively straightforward are now much more complex. Navigating this new landscape typically requires professional advice to get right.

This note summarises some of the ways in which you might structure a residential property purchase and the main tax considerations to bear in mind throughout the lifecycle of property ownership.

What are my options?

There are an almost infinite variety of ways to structure a UK residential property purchase, and each method has its own advantages and risks depending on a person’s or family’s circumstances. However, there are three principle ways in which you might hold a UK residential property: in your own name, through a company, or through a trust.

A high-level comparison of each of these three options is below, based on the UK’s tax regime for the 2021/2022 tax year. This summary should be read alongside the further information provided in the remainder of this note, and it is important to seek professional advice where appropriate.

| Individual | Company | Trust |

| On purchase | ||

| SDLT at rates up to 12% for UK residents or 14% for non-residents (or up to 15% and 17%, respectively, for additional properties) | SDLT at either 15% or rates up to 15% for UK residents, or at 17% or rates up to 17% for non-residents | SDLT at up to 15% for UK residents or 17% for non-residents |

|

During ownership |

||

|

No ATED Income tax on rental income at rates between 20% and 45% |

ATED may be charged at between £3,700 and £237,400 each year |

No ATED Income tax on rental income at rates between 20% and 45% |

| On sale | ||

| Main residence exemption available otherwise capital gains tax at 18% or 28% | Corporation tax at 19% | Main residence exemption available, otherwise capital gains tax at 18% or 28% |

| On death | ||

| Inheritance tax at up to 40% | Inheritance tax at up to 40% | Inheritance tax at up to 40% |

Tax on purchase

If you buy a property in England or Northern Ireland, you will have to pay stamp duty land tax (SDLT) on the purchase price. Properties in Scotland and Wales attract similar land transaction taxes.

Historically, SDLT was relatively straightforward for most residential property purchases. However, it can now be extremely complicated as there are now many possible sets of rates that might apply, depending on your circumstances and the structure used. This can have a substantial effect on the cost of buying a property.

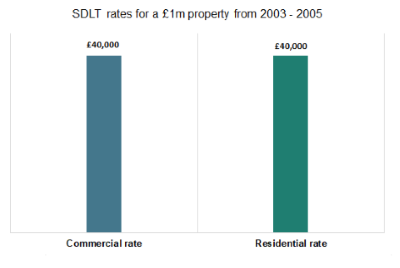

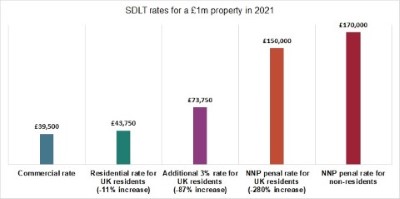

Take, for example, a £1m property. Between 2003 and 2005 the SDLT treatment was relatively straightforward and the type of property and the buyer’s circumstances made little practical difference. If that same property was bought at the same price now, getting the SDLT wrong by failing to secure potential reliefs and tax-saving opportunities could cost as much as £130,500 (more than 10% of the purchase price), as shown below.

The main SDLT rates which can now apply to a residential property purchase after October 2021 are as follows:

| Purchase price | SDLT rates for UK resident individuals | SDLT rates for UK resident companies | SDLT rates for UK resident trusts | ||

| Standard | Additional | Personal use | Business use | ||

| £0 - £125,000 | 0% | 3% | 15% | 3% | 3% |

| £125,000 - £250,000 | 2% | 5% | 15% | 5% | 5% |

| £250,000 - £925,000 | 5% | 8% | 15% | 8% | 8% |

| £925,000 - £1,500,000 | 10% | 13% | 15% | 13% | 13% |

| £1,500,000+ | 12% | 15% | 15% | 15% | 15% |

| Purchase price | SDLT rates for non-UK resident individuals | SDLT rates for non-UK resident companies | SDLT rates for non-UK resident trusts | ||

| Standard | Additional | Personal use | Business use | ||

| £0 - £125,000 | 2% | 5% | 17% | 5% | 2% |

| £125,000 - £250,000 | 4% | 7% | 17% | 7% | 7% |

| £250,000 - £925,000 | 7% | 10% | 17% | 10% | 10% |

| £925,000 - £1,500,000 | 12% | 15% | 17% | 15% | 15% |

| £1,500,000+ | 14% | 17% | 17% | 17% | 17% |

As the lower rates in the left-hand column show, from an SDLT perspective it is now normally better to buy a property for personal use in your own name, rather than through a corporate or trust structure.

However, SDLT is complex and there are various ways in which the tax due can be significantly increased or reduced, depending on your circumstances. You should seek expert advice to ensure that the SDLT cost is mitigated as far as possible and to protect against the risks of getting the SDLT treatment wrong.

Tax during ownership

The annual tax on enveloped dwellings (ATED) is payable every year in which a privately held company owns a UK residential property valued at more than £500,000 (including properties held by partnerships with a corporate partners and certain collective investment schemes). This tax applies whether the entity is UK or non-UK resident.

ATED is levied at the amounts set out in the table below.

| Property value | Annual charge |

| More than £500,000 up to £1 million | £3,700 |

| More than £1 million up to £2 million | £7,500 |

| More than £2 million up to £5 million | £25,300 |

| More than £5 million up to £10 million | £59,100 |

| More than £10 million up to £20 million | £118,600 |

| More than £20 million | £237,400 |

No ATED is payable if the company in question runs certain businesses with respect to the property for the whole year, including property development and commercial lettings to third parties. However, the company must still file annual ATED tax returns and obtain valuations at certain intervals.

The easiest way to ensure that no ATED is payable is to hold the property outside of a company. If the property is held in your own name, or through a trust with certain characteristics, then no ATED is payable and no related filings are required.

If you intend to let the property out to a tenant, UK tax will be payable on the rent. If you hold the property in your own name, or through a trust, the tax rate charged on the rent depends on the extent of your (or the trust’s) UK income, as shown below:

| Amount of income | Tax rate on rental income |

| Up to £12,570 | 0% |

| £12,571 to £50,270 | 20% |

| £50,271 to £150,000 | 40% |

| Over £150,000 | 45% |

If the property is held by a company, then both UK and non-UK resident companies will be subject to corporation tax on their UK rental income at a rate of 19%.

Certain expenditure associated with the property may be deductible to reduce the total tax payable on rent, including maintenance and finance costs. There are complex rules that can restrict how much finance costs can be deducted, and these depend on whether the property is held by an individual or a company. These rules can have a significant influence on how tax-effective each structure will be.

Tax on sale or gift

Historically, non-UK residents did not always have to pay UK capital gains tax when selling or gifting a UK property. However, a change in the law in 2015 now means that anyone who sells or gives away a UK residential property can now expect to pay capital gains tax on any uplift in value from that time, irrespective of where they are resident.

The rates of tax that apply to gains made from UK residential properties are as follows:

| Type of entity | Tax rate on gains |

| Individual | 18% or 28% (depending on total UK income and gains in the year of sale/gift) |

| Trustee | 28% |

| All companies until April 2023 | 19% |

Notwithstanding the tax rates shown above, if you hold the property in your own name (or through a trust) the first part of any gain on a sale or gift would be exempt from tax. Under current rules, this would exempt the first £12,300 of any gain from tax for individuals and £6,150 for most trusts.

Crucially, you would also not normally be liable to any UK capital gains tax whatsoever for periods in which you occupy the property as your main or only residence. If you are not a UK tax resident, you can still qualify for this exemption, but you must also live in the property for at least 90 days in a tax year (which might jeopardise your non-tax resident status). The exemption may also be available if the property is held on trust. However, if a company holds the property, the exemption is not available.

It is not generally possible to avoid capital gains tax by selling the shares in a company which holds a UK property, rather than by selling the property itself. Tax rules treat a sale or gift of 25% or more of the company’s shares in much the same way as a sale or gift in the underlying property and these rules apply wherever the company in question derives at least 75% of its gross asset value from UK property.

Tax on death

UK residential properties held directly by individuals have always been exposed to UK inheritance tax on death or on certain gifts. However, individuals who were not UK domiciled could sometimes keep UK properties outside the scope of inheritance tax charge by holding them in non-UK company structures. These rules have recently changed though, so that now all UK residential properties are exposed to inheritance tax, whether held directly or indirectly through structures (unless the structure in question is held by a wide range of unconnected persons, such as an investment fund).

This means that shares in most companies will now be subject to UK inheritance tax to the extent that their value is attributable to UK residential property (including when the company is owned through a trust). These rules also apply to loans used to buy, enhance or maintain the property.

As a general rule, there is now therefore no inheritance tax advantage in holding a UK residential property through a corporate structure. On the death of the owner the value of UK residential property will be subject to inheritance tax at 40% (save to the extent an exemption or relief applies). However, debt secured on the property can reduce the amount within the tax charge, subject to certain conditions.

If you hold a property in your own name and you leave it to someone else on your death, the capital gains tax value of the property for the new owner would be reset on your death. This means that anyone who inherits the property from you would only pay capital gains tax on a later sale or gift to the extent the property has increased in value since your death.

If you hold the property through a company, the value of the company’s shares are similarly reset, but the value of the property is not. Property held in trust does not benefit from this value reset on the death of the settlor nor (usually) on the death of a beneficiary.

What to do – some suggestions

The UK’s tax regime is currently designed to discourage corporate and indirect ownership of residential properties through structures. As explained above, it is now normally more tax-efficient and straightforward to hold a UK residential property for personal use in your own name, rather than through a company or trust.

Personal ownership can provide access to lower rates of SDLT on purchase, it avoids an ATED charge during ownership, and may exclude any capital gains tax charge on a sale or gift if the property is to be your main residence. Personal ownership is also legally more straightforward, simpler and more cost-effective in terms of administration. Many of the historic advantages previously offered by offshore corporate and trust structures no longer exist, most notably shelter from UK capital gains tax and inheritance tax.

However, there do remain circumstances where trust or corporate structures are appropriate and offer certain advantages. For example, properties which are acquired for the purposes of a property rental, development or trading business may benefit from being held in a company (primarily because of the difference in tax rates between corporation tax and personal income tax). Company ownership can also be advantageous where limited liability is required. In addition, there may be good non-tax reasons to hold properties through a trust, such as confidentiality, estate planning and asset protection.

So when it comes to deciding how to structure ownership of a UK residential property, there is no ‘one-size fits all’ answer. Before buying a UK residential property you should think carefully about your options and the best way to structure your ownership.

Our Tax and Private Client team is well-placed to provide you with tailored professional advice on the best solution for you and your family.

If you require further information about anything covered in this briefing, please contact James Bromley, or your usual contact at the firm on +44 (0)20 3375 7000.

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, June 2021