What are matrimonial property regimes?

Blog

Matrimonial property regimes are easily overlooked and can be a trap for the unwary client with cross-border interests. But what are they?

Certain jurisdictions impose complex rules for the joint ownership of property by spouses, and this can significantly affect tax and succession planning.

Planning around such regimes is second nature for advisers in those jurisdictions that have them, but the relative freedom given to spouses under English law means that the impact of an overseas matrimonial regime can be missed.

Matrimonial property regimes are not only relevant in cases of divorce, and it is not just married couples that are affected. Some jurisdictions impose matrimonial property regimes on couples in unmarried long-term relationships or who cohabit.

Advisers supporting high net worth clients with overseas connections and interests, including family offices, trustees and lawyers, need to know if a matrimonial property regime might apply to their clients and, if it does, what to do about it.

What is a matrimonial property regime?

Different countries and cultures have different ideas about marriage and how significantly it should affect asset ownership.

Each country (and in federal countries such as the USA, each state) has very specific rules which should be considered carefully in each case.

Some countries, such as Germany, France and Italy, allow each couple to choose what regime will apply to them.

Broadly speaking, there are four categories of regime:

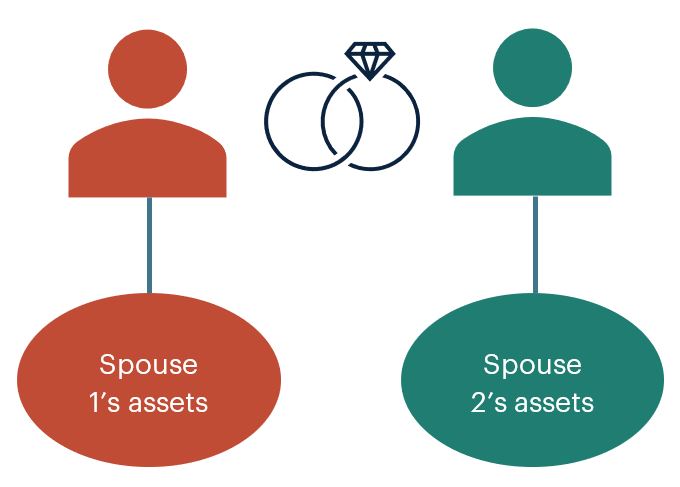

1. Separation of property

In jurisdictions with a separation of property regime, all property acquired before and during the marriage is each spouse’s own separate property, and each person in theory has full freedom of disposition, both in their lifetime and on death.

This is the regime that applies in England and many other “common law” countries such as Australia, New Zealand, India and 41 of the 50 states in the USA.

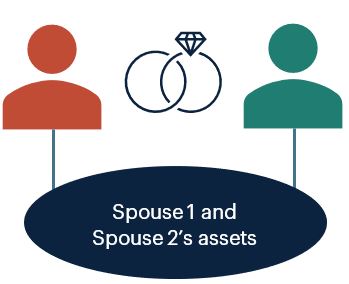

2. Full community of property

Where there is full community of property, all assets acquired before and during a marriage will be treated as held jointly by the spouses, and this may include property inherited by one of them.

Full community of property is rarely imposed as a default but is offered as an option in countries such as France where a couple can elect that full community of property will apply to their assets after marriage.

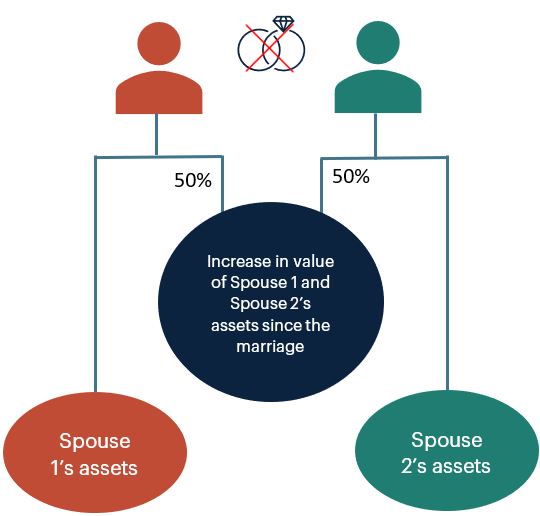

3. Deferred community of property

Deferred community of property is only relevant when a marriage ends. Every asset is treated as separately owned during the marriage, but a spouse acquires joint ownership rights in their partner’s property on death or divorce.

This is the default regime in Scandinavian countries and some Central American countries like Costa Rica. Germany has a similar regime known as “the community of surplus” where, on death or divorce, the gains / increases in value in each spouse’s assets are calculated and then divided on an equal basis.

4. Community of acquisitions

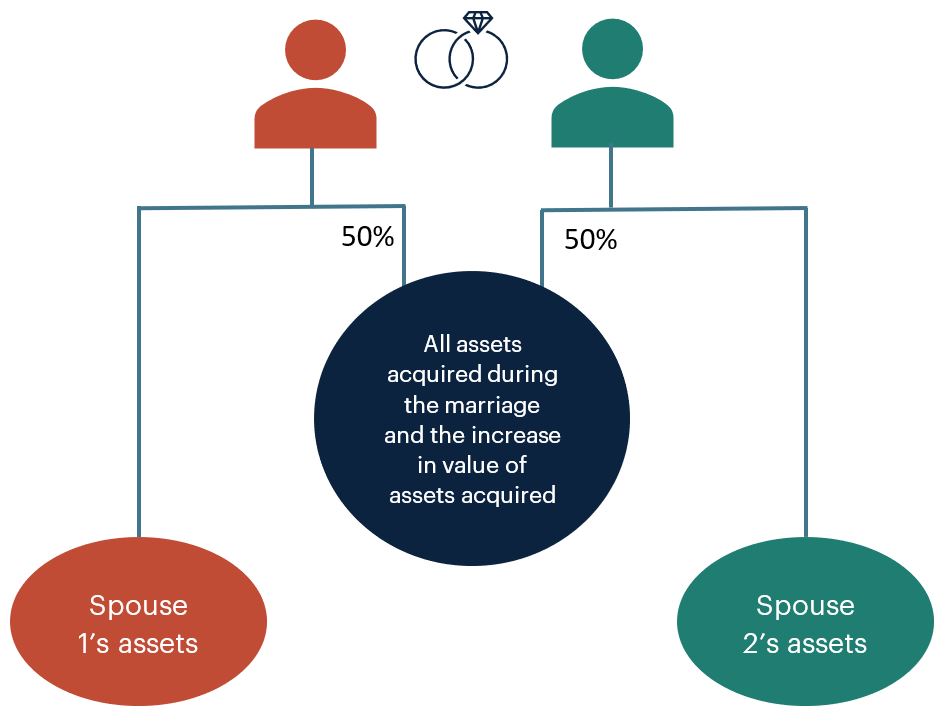

Assets which are acquired by either spouse during the marriage are treated as jointly owned, but assets acquired prior to the marriage or inherited at any time are separately owned.

This is the default regime in France, Russia, China, Spain (apart from in Catalonia and the Balearic Islands, which have separation of property), and many countries in South America (for example, Argentina, Brazil and Colombia).

What if there are ties to more than one country?

Conflict of laws issues inevitably arise where couples have ties to more than one country, and in-depth consideration must be given to which laws apply. However, a series of international agreements are in place to help.

For marriages celebrated between 1 September 1992 and 28 January 2019, the Hague Convention of 14 March 1978 applied in certain EU member states (for example France, the Netherlands and Luxembourg) and determined that where spouses move to a new jurisdiction after their marriage, the rules of that jurisdiction will replace those of the former regime.

The Matrimonial Property Regulation (Regulation 2016/1103) was introduced in June 2016 as an attempt to simplify matrimonial property regimes in the European Union. The Regulation mainly concerns divorce and family matters and applies to marriages that took place on or after 29 January 2019 in 18 of the 28 member states of the EU.

The Regulation applies new solutions to conflict of laws on, for example, jurisdiction, applicable law and the recognition and enforcement of decisions. It sets out a series of tests to help couples determine which regime applies to them.

The EU Succession Regulation (Regulation 650/2012, also known as Brussels IV) applies similar solutions to the assets of a person’s deceased spouse.

Forced heirship

Forced heirship is a topic that needs to be considered alongside matrimonial property regimes as it can affect spouses’ ability to give assets away during their lifetime and on death. Forced heirship regimes are the norm in EU jurisdictions and other civil law jurisdictions such as Brazil, Japan and Switzerland.

Islamic law (Shari’a) imposes a strict forced heirship regime, which includes a clawback of lifetime gifts both to other persons and (if pursued successfully) into trust. As Shari’a does not allow property to be jointly owned by spouses, lifetime gifts between them can be subject to this clawback, too.

When making a global estate plan, high net worth individuals with connections to jurisdictions that have a matrimonial property regime should obtain specialist advice to ensure that their planning takes into account the impact of the regime on their personal circumstances.

If you require further information about anything covered in this article, please contact Nicola Pomfret, Will Cudmore or your usual contact at the firm on +44 (0)20 3375 7000.

This publication is a general summary of the law as at the date of publication. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, February 2023