The importance of Lasting Powers of Attorney

Insight

Purpose and scope of LPAs

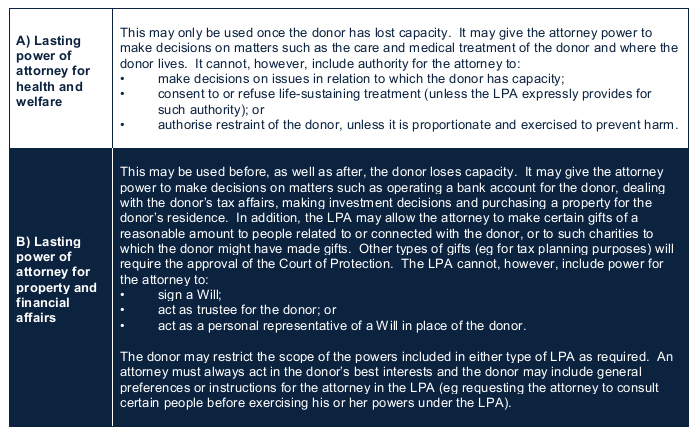

The Mental Capacity Act 2005 introduced the Lasting Power of Attorney ("LPA") which replaced the Enduring Power of Attorney ("EPA") on 1 October 2007. LPAs allow an individual ("the donor") to choose one or more persons ("the attorney") to make certain decisions on the donor’s behalf. Two different types of LPA may be made as follows:

How do LPAs differ from EPAs

An LPA is very similar to an EPA, but has a wider scope (an EPA could not be used to give an attorney authority to make health and welfare decisions on behalf of the donor). Another important difference is that LPAs must be registered with the Office of the Public Guardian ("OPG") before they can take effect. In contrast, EPAs were effective on signing and only had to be registered when the donor lost capacity.

Choosing an attorney

The choice of attorney is obviously of great importance since the donor will be relying on the attorney to do things on the donor’s behalf at a time when the donor can no longer deal with his or her own affairs. A spouse or partner, professional adviser, trusted friend or relative can be appointed. The attorney must be an adult when he or she signs the LPA. A trust corporation (but not an ordinary limited company) can be an attorney, but only in relation to a property and financial affairs LPA. It is very important that attorneys, when agreeing to their appointment, understand and accept the responsibility which will be placed on them as attorneys: they cannot later designate others to act as attorneys in their place. An attorney may resign from the appointment if he or she becomes unable or unwilling to act (although a set procedure must be followed if the LPA has been registered).

Choosing more than one attorney

The donor can appoint more than one attorney. If so, the donor must decide whether he or she wants the attorneys always to act together or, if they are permitted, act "jointly and severally" (ie they may all act together but they can also act separately). Alternatively the donor can specify that the attorneys are to act jointly in some matters and jointly and severally in others. If two attorneys are appointed jointly the appointment will terminate on the death or incapacity of one of them and the LPA will no longer be operative. As a result it is usually preferable to appoint two or more attorneys jointly and severally.

The LPA may appoint a substitute attorney, but it cannot give the attorney power to appoint a successor. In addition, a donor does not have power to remove one attorney leaving others in place (if he or she wishes to replace an attorney, the donor will need to revoke the whole LPA and make a new one). Nor can the donor state that the attorneys can act by majority vote. This area is complex and professional advice is recommended.

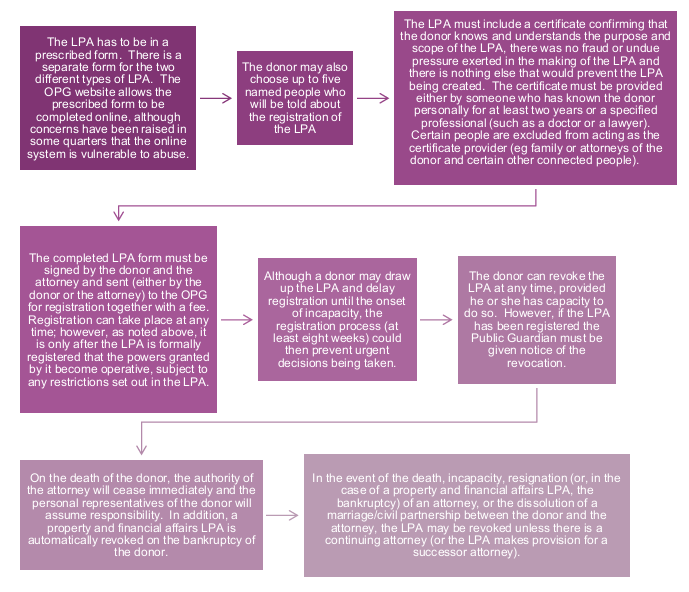

Procedure for making an LPA

How are existing EPAs affected?

Any EPA made before 1 October 2007 remains effective. It is not possible, however, to convert an existing EPA to an LPA. If donors wish to replace an existing EPA with an LPA they will have to revoke the EPA and draw up a new LPA.

Next steps

Although the LPA forms enable people to draw up and complete LPAs for themselves, there will be many circumstances where legal advice is recommended: for example, if a person has complex business or financial interests, or if there are particular medical considerations.

If you require further information about anything covered in this briefing, please contact Richard McDermott, or your usual contact at the firm on +44 (0)20 3375 7000.

This publication is a general summary of the law. It should not replace legal advice tailored to your specific circumstances.

© Farrer & Co LLP, January 2020